Understand how to price your home correctly

The single most important factor in the sale of your home is the price. Pricing your home effectively will get you the most money in the shortest amount of time. A real estate agent can help you with pricing your home, but the final pricing decision is yours. So, even if you use the services of a real estate brokerage firm such as Tellus Real Estate Solutions, it is important that you understand how your home should be priced.

Most agents will warn you against over-pricing, and so do we. The main argument regarding over-pricing is that you lose a sense of ‘freshness’ and an initial boost in showing during the first few weeks. This is at least partially true, and here is why: When a home is initially listed, it will tend to get quite a few visits from agents checking out the new homes on the market. Secondly, when you first enter the market you have a chance to make an impression on all the buyers in the market at that particular time as your home will appear in the search results based on their specific requirements . Most search systems, including the Tellus Real Estate Solutions’ system, send prospective buyers a list of “what is new” that matches their search criteria. After that initial large group of existing buyers view your listing, you will only have the opportunity to make an impression on a few new buyers each week.

Your objective is to price your home so that it meets your intended goals. For most sellers, that goal is to get the most money in the least time with the least amount of hassle. For some sellers, the goal may be to get the most money, period. With others, it may be to get a specific amount of money or to sell quickly. Assuming you are a typical seller, this means pricing your home as high a possible while still appealing to prospective buyers that are willing to view the home. You don’t want to have your home priced at $500,000 when every similar home in the neighborhood is priced at under $400,000. A buyer is unlikely to come take a look. You can’t depend on curiosity winning out over skepticism. You also don’t want to price your home too low. A low price might encourage multiple offers, however you shouldn’t risk that the only offer you get will be at that “too-low” price. Additionally, a low price can raise red flags for buyers in that it might suggest that there are problems with the home that really don’t exist.

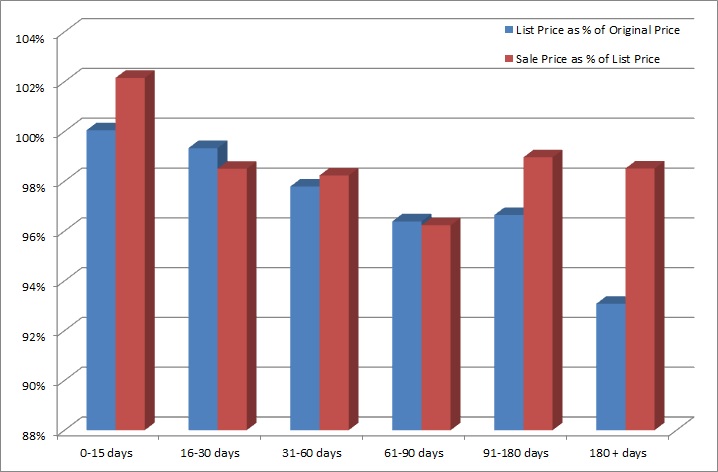

Don’t be afraid to push the price just a little bit though. Price reductions are common. Take a look at the following chart, which shows the trends for listings with price cuts. Each month, between 30% and 50% of all homes listed are reduced in price suggesting that they were overpriced to begin with.

Your best plan of action, in order to appropriately price your home, is to use the same valuation methods that banks ask real estate agents to use when they perform a Broker’s Price Opinion (BPO) in order to understand market value. Typical instructions to the agent include:

- Compare the subject to recently sold homes: The agent is asked to provide three examples of homes that have recently sold that match the target property as closely as possible. The agent then comments on factors that make each example property inferior or superior to the subject property.

- Compare the subject home to homes currently on the market: The agent performing the valuation then repeats the process using properties currently on the market, including those under contract if possible, as well as those that are not under contract.

- Comment on the neighborhood and overall market: The instructions will also request the agent comment on the neighborhood and the overall market including price trends, and take those factors into account. The banks expect the final valuation price, on a per square foot basis, to be the most similar between the sold properties and the subject.

How to choose comparable properties when selling your home

The most important decision when valuing your home based on comparable properties is to choose the correct comparable property. Again, you can look to BPO instructions provided by banks and their service providers as a guide. The following factors are ones that are typically taken into account:

- Physical location: Comparable properties should be located as close to the subject property as possible, typically within a ½ mile in urban areas, further out in suburban areas and up to 10 miles in rural areas. You will want to be aware of both real and psychological barriers between neighborhoods.

- Size: The square footage should be within 10% if possible and 20% on the outside.

- Bedrooms and bathrooms: The number of bedrooms and bathrooms should be as close as possible. Additionally, keep in mind that values drop greatly between three bedroom homes and two bedroom homes. Similarly, there is a price jump when going from one bathroom to two bathrooms.

- Age: Look for comparable properties within a similar age range, generally within 10 years of your property. Be aware of significant dates. For example, pre-1978 homes may contain lead paint. And, in 1997 there was a significant change in building codes. As homes get older, the range of comparable properties becomes greater. For example, a 1920s home is similar to homes from the early 1900s, while newer homes should be compared to ones much closer in age. 2010 homes would compare to 2008 homes, but not to 2001 homes.

- Construction style/architecture: If at all possible compare ramblers to ramblers, split-levels to split-levels and manufactured homes to manufactured homes. It’s also important to know that a rambler will generally be higher valued than a two-story home of the same square footage and that split-levels will be lower valued.

- Other features: Compare other features to judge relative values. Construction quality, number of fireplaces type of flooring, counter tops and lot size are just some of the factors that affect value.

Where to find comparable properties when valuing your home

Finding current comparable property listings is easy. You can perform a search from almost any real estate agent’s website to see current listings. You may even be able to narrow your search to only those properties that are under contract. You can try it now by using the Tellus Real Estate Solutions Advanced Search tool.

How to find information about recently sold properties

Most real estate agent sites can’t provide this information simply because it isn’t published by the MLS. In that case, here are some options:

- Contact a real estate agent: Even though multiple listing services, such as Northwest MLS, don’t publish sold data publicly, real estate agents can do back-end searches to pull comparable property listings. How else would they do a BPO for a bank? If you would like Tellus Real Estate Solutions to provide you a list of comparable properties please complete our BPO Request Form.

- Search recent sales on Zillow

- Search recent sales on Trulia

- Check your county website: King County’s iMap property search gives you the option of showing all sales in the last three years, in any view on the map. The only negative is that three years is more data than you may need. It also seems like the county website isn’t updated as quickly as the commercial websites. It also doesn’t link you back to the original listing like the others do, assuming the original listing was posted to their sites.

- Contact a title company: Request that they search recent sales using your specific search parameters. The advantage in this instance is that they can typically provide you the data in an Excel spreadsheet.

- Other services can provide similar information. Some services are very beneficial but most are too expensive to be of use to the individual user. For example, services from CoreLogic, such as Realist, are aimed at large brokerage firms or even MLS organizations. Since the NWMLS provides Realist data to its members, Tellus Real Estate Solutions is able to run these reports for you.