Agency and dual agency are incredibly challenging issues in real estate. They are, I think, very hard to explain clearly. More importantly, they are areas that can be hard for some brokers to handle ethically and legally, especially when you are talking about dual agency. This can be true for the most honest and ethical broker, simply because we are human. I make it a point to discuss agency with potential clients. Its an important part of the job. This post is an attempt to put some of those explanations in writing so I can point clients at the scenarios later.

Before we go further, here is a link to the Washington State “Law of Real Estate Agency” pamphlet on the Tellus Real Estate website. We provide a link directly from our website where it is easy to get to, so clients and agents can quickly refer to it. This pamphlet spells out the legal obligations of brokers and managing (or designated) brokers when it comes to agency. It goes to great length to define certain concepts such as “material facts” that all buyers, seller, landlords, and tenants should understand.

There is a fairly straightforward set of possible agency relationships in a real estate transaction. They are:

- Neither buyer nor seller has an agent

- Both buyer and seller have agents with separate companies

- Seller with an agent and buyer without an agent

- Buyer with an agent and seller without an agent

- Buyer and seller with separate agents within the same brokerage

- Buyer and seller with the same agent

Let’s look at what each of these looks like:

Neither buyer nor seller has an agent

On the surface, this seems easy and the obvious scenario is one where a person selling a house ‘for sale by owner’ (FSBO) finds a buyer. No real estate agent is involved, so there is no agency relationship. But, we’ve also seen cases where a FSBO owner or buyer asks a real estate agent to handle paperwork for a fee, without creating an agency relationship. The challenge here is that the agent will likely, at some point in the transaction, offer advice to either the seller or buyer, thereby creating an agency relationship without meaning to do so. As the owner of a real estate brokerage, I see this as a recipe for law suits, and since ultimately it is my responsibility, I don’t want my brokers doing this. If a FSBO buyer and seller needs help with paperwork, they can contact an escrow company or an attorney to guide them through the process.

On the surface, this seems easy and the obvious scenario is one where a person selling a house ‘for sale by owner’ (FSBO) finds a buyer. No real estate agent is involved, so there is no agency relationship. But, we’ve also seen cases where a FSBO owner or buyer asks a real estate agent to handle paperwork for a fee, without creating an agency relationship. The challenge here is that the agent will likely, at some point in the transaction, offer advice to either the seller or buyer, thereby creating an agency relationship without meaning to do so. As the owner of a real estate brokerage, I see this as a recipe for law suits, and since ultimately it is my responsibility, I don’t want my brokers doing this. If a FSBO buyer and seller needs help with paperwork, they can contact an escrow company or an attorney to guide them through the process.

Both buyer and seller have agents from separate companies

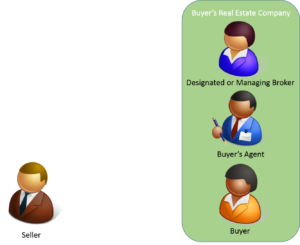

This is the clearest case of NOT having dual agency. In order to understand why, it is important to understand who the agents are. In real estate brokerage, there are several entities (roles) at the real estate company that represent you when you are the buyer or seller. The same person might fill all the roles, or each role might be filled by a separate person. The roles are:

This is the clearest case of NOT having dual agency. In order to understand why, it is important to understand who the agents are. In real estate brokerage, there are several entities (roles) at the real estate company that represent you when you are the buyer or seller. The same person might fill all the roles, or each role might be filled by a separate person. The roles are:

- Buyer or seller’s broker/agent – This is the person who you work with directly as the buyer or seller

- Managing broker – This is the person who directly supervises your broker. They must have a special license and they are legally responsible for the actions of your individual broker.

- Designated broker – this is the person who is responsible for the actions of the entire real estate company and all the managing brokers and individual brokers in the company. For all intents and purposes, they are the company. If you sign a listing contract or a buyer representation agreement, you are actually making a contract with the company and this person. That contract allows them to assign someone (the broker mentioned above) as their representative when working with you.

You will notice I didn’t use the word “agent” here. The State of Washington has updated the terminology when referring to brokers and agents in order to make things more clear. Any of the people serving in the roles above can be an “agent” (can owe you an agency obligation as defined in that pamphlet we mentioned earlier). It is also possible for them to be other peoples’ agents or to be dual agents.

So, back to this scenario. In the scenario where the brokers working with the buyer and seller are each from different brokerage companies, then everyone in the roles I mentioned is an agent for only 1 person, either the buyer or the seller.

This is nice and clear, and much less likely to cause a lawsuit than any other scenario. And, in most cases, unless you are working with a large brokerage company with many brokers, this will the scenario you are most likely to encounter as a buyer or seller, assuming you are working with a broker.

Seller with an agent and buyer with no agent

So, when would we see this? The easiest scenario to imagine is where a seller has listed their property with a brokerage and the broker assigned is their agent. That broker holds an open house and a potential buyer comes into the house, and does not have their own real estate broker working with them. The buyer says, “I want to buy this house.” After confirming the buyer does not have an agent, the seller’s broker (the listing broker) should first make sure the buyer understands that they, the broker, represent the seller, and give the buyer a copy of the Law of Real Estate Agency Pamphlet. This is required, legally. If the buyer wants to go ahead with the offer, then the broker would fill out the offer paperwork.

So, when would we see this? The easiest scenario to imagine is where a seller has listed their property with a brokerage and the broker assigned is their agent. That broker holds an open house and a potential buyer comes into the house, and does not have their own real estate broker working with them. The buyer says, “I want to buy this house.” After confirming the buyer does not have an agent, the seller’s broker (the listing broker) should first make sure the buyer understands that they, the broker, represent the seller, and give the buyer a copy of the Law of Real Estate Agency Pamphlet. This is required, legally. If the buyer wants to go ahead with the offer, then the broker would fill out the offer paperwork.

This scenario may not be a problem if the buyer is fairly sophisticated and really understands what is going on. But, many buyers in this situation really don’t understand. That broker is the seller’s agent and is not required to look out for the buyer’s best interests. They are not supposed to lie, but they are not required to protect the buyer from their own mistakes. For example, if the buyer does not ask for an inspection contingency when describing the offer, then the broker, who is the seller’s agent, would probably not mention that fact to them (depending on if they felt it was in the seller’s best interest to have the buyer inspect or not).

Another problem I see, from the brokerage owner perspective, is that it may be hard for the broker/agent to avoid ‘helping’ the buyer, even though they don’t legally represent them.

Buyer with an agent, and seller with no agent

This is a lot more common than the previous scenario. The classic form it takes is the For Sale by Owner (FSBO) property where the seller is willing to pay the broker bringing a buyer a commission. While more common than the previous situation, it has many of the same challenges. The broker, who legally represents the buyer, should not be giving the seller advice on how to get more money or in how to negotiate the deal. For example, if seller doesn’t ask for earnest money (or asks for less than typical in the market), the buyer’s agent would be unlikely to offer up that fact to them, since it hurts their buyer client by putting more of their money at risk.

This is a lot more common than the previous scenario. The classic form it takes is the For Sale by Owner (FSBO) property where the seller is willing to pay the broker bringing a buyer a commission. While more common than the previous situation, it has many of the same challenges. The broker, who legally represents the buyer, should not be giving the seller advice on how to get more money or in how to negotiate the deal. For example, if seller doesn’t ask for earnest money (or asks for less than typical in the market), the buyer’s agent would be unlikely to offer up that fact to them, since it hurts their buyer client by putting more of their money at risk.

I think there is also a challenge here because of who is paying the money. The seller may feel later than the broker was supposed to advise them about how to proceed since they were paying them.

Buyer and seller with separate agents within the same brokerage

This is probably the second most common scenario. If you work with a large real estate brokerage with many offices (which may or may not be one of the national or regional franchises like CENTURY 21, Windermere, John L Scott, Coldwell Banker, etc.), there is a decent chance that if you are the seller, the buyer may be represented by a broker from the same company as your listing agent. Or, if you are the buyer, you may end up putting an offer in on a home listed by someone else in that company.

This is probably the second most common scenario. If you work with a large real estate brokerage with many offices (which may or may not be one of the national or regional franchises like CENTURY 21, Windermere, John L Scott, Coldwell Banker, etc.), there is a decent chance that if you are the seller, the buyer may be represented by a broker from the same company as your listing agent. Or, if you are the buyer, you may end up putting an offer in on a home listed by someone else in that company.

In this scenario, the individual brokers representing the buyer and seller are each single agents, just as if they worked for separate companies. However, as you work up the management and ownership chain in the business, someone will become a dual agent. If both of those individual brokers are supervised by the same managing broker, the managing broker will be a dual agent. If all else fails, the designated broker that runs the company, will be a dual agent.

Generally, this is no more a problem than it is when the individual brokers work for different companies. Typically, the designated broker’s involvement in the transaction is to review paperwork to make sure that company policies and various legal requirements are met. They do not have a direct stake in the transaction.

However, because the company will typically stand to make more money if both the buyer’s side and seller’s side of the commission stay with the company, there may be more pressure to keep the transaction going when there are problems. For example, what if the buyer is having second thoughts after the inspection. They are wondering if they should really by the home. Their agent goes to his or her managing broker, or the designated broker, for advice. That designated broker is a dual agent. They have the challenge of fairly and legally representing the needs of both the buyer and seller. They also stand to make more money, which might have an unintended (and even unrealized) influence on their thinking.

As both the designated broker and an individual broker directly involved in deals, I’ve been a dual agent many times. It is tough. I make a point of reminding my clients about the possible conflicts of interest, especially when it’s a tough call. I let them know up front that it’s possible that the money I stand to make on that transaction could affect my thinking. I also remind them, myself, and any broker working for me, that if I do make a point of being honest, that I’ll make up the money later if I don’t make the money now.

Buyer and seller with the same agent

There was a time when all real estate brokers in Washington State represented the seller by default. As you can imagine, that caused a lot of confusion for buyers who sure felt they were being represented by their broker. Today, the law has changed and it is basically the opposite. All brokers are assumed to represent the buyer unless they have a signed contract with the seller. That makes things more clear.

There was a time when all real estate brokers in Washington State represented the seller by default. As you can imagine, that caused a lot of confusion for buyers who sure felt they were being represented by their broker. Today, the law has changed and it is basically the opposite. All brokers are assumed to represent the buyer unless they have a signed contract with the seller. That makes things more clear.

Now, when the buyer and seller have the same broker representing them, we have a clear case of dual agency. Everyone in the chain of command for that broker is also a dual agent. Happily this is typically the least frequent scenario for most brokers. Some brokers specifically avoid it by saying they will represent only the seller or only the buyer in any transaction. This is great! It’s the easiest and safest way to avoid lawsuits and make sure you are not hurting your clients. Why? Because of all the same issues mentioned when the brokerage acts as dual agent, only all the issues are intensified. If a managing broker or designated broker is a dual agent, they may not even get part of the commission (this depends on the specific arrangement with the brokers and brokerage). But, if you are the individual broker, unless you work on a salary, you get paid more if you represent both buyer and seller. Sometimes it is a LOT more. I know some brokers who charge very small commissions for listings, simply because they expect to make it up by representing buyers and they encourage the seller to pay the buyers’ agents well.

For me, it is really dependent on the clients and the situation on whether I would be willing to act as a dual agent. When listing properties, I ask the seller up front how they feel about it. In most cases, sellers expect me to go find buyers, so they think it silly that I would NOT act as a dual agent. In fact, they might be mad if I don’t, and it hurts getting their house sold.

With buyers, it largely depends on how I met them and what kinds of homes they are interested in. If I met them because they contacted me about a listing I represent, I need to have the conversation immediately. I always ask if they have a broker representing them, and if they do not, I then explain that I currently represent only the seller and if they would like me to represent them, I can but there are issues I need to explain. Admittedly, the conversation make happen over a period of emails, phone calls, etc. It doesn’t make sense to overload your potential clients with information too early. The most important thing to remember is to make it clear what is happening, before anyone starts making decisions. Washington State law requires that you make your agency relationship clear to anyone you are working with. There are no exceptions to that rule.

Ok. Hopefully I’ve explained the scenarios, and the challenges in each one. If you have more questions or comments, let me know.