Class descriptions

Tellus Real Estate Solutions’ satellite real estate school provides pre-licensing, managing broker licensing, and continuing education courses. These courses are provided at a discount from the standard Rockwell Institute price. You can register online or over the phone by calling Rockwell Institute directly at 800-954-5150 and letting them know you are registering as a Tellus Real Estate Solutions student. See the descriptions below for information about each class. Click this link for a demo.

Washington State Pre-license Package (90 clock hours)

This 90 clock hour package combines Washington Fundamentals, Real Estate Practices, and the Broker’s Cram to provide you with the best pre-license education available. You must complete both Fundamentals and Practices before taking the Washington real estate license exam. You may choose either the live-lecture or the online course formats. Save money by choosing this package instead of signing up for each course separately!

Washington Real Estate Fundamentals (60 clock hours)

Washington Real Estate Fundamentals is a 60-hour course that must be successfully completed before you can sit for the Washington real estate license examination. (You must also complete the 30-hour Real Estate Practices course.) Fundamentals is a comprehensive course that is directed at someone with little or no experience in real estate. About 90% of students who take this class pass the license exam on their first attempt. Please note: If you would prefer to take Fundamentals in a live lecture setting, Rockwell also offers Fundamentals classes at our Bellevue campus.

Washington Real Estate Practices for Pre-license Only (30 clock hours)

This 30 Clock Hour course is a practical course for new agents. It offers guidelines in areas such as: listing agreements and purchase and sale agreements; pricing property; qualifying the purchaser; agency relationships; financing; and other information pertinent to the new real estate agent. All those seeking a real estate broker’s license on or after July 1, 2010 must take this course as part of their pre-license requirements.

Washington Broker’s Cram

The online Broker Cram takes all the information taught in Rockwell’s live Cram course, puts it in a highly usable format on the computer, and allows you to learn it at your own pace. You are shown what is likely to be tested on the license examination, plus you get the opportunity to answer hundreds of practice exam questions as well as take several practice exams. The Cram narrows your search for relevant topics, saving you both time and unnecessary stress. As the exam date approaches, nothing is more frustrating and stressful than studying in great detail information that may be altogether unimportant. Save yourself a lot of needless grief and enroll in the Cram course today.

Washington State Managing Broker’s Special Licensing Package (90 clock hours)

Sign up for the 90 clock hour Managing Broker’s Special package and save money in pursuit of your managing broker’s license. The package includes the three 30-hour courses you must complete before you can take your managing broker’s license exam: Advanced Real Estate Law, Brokerage Management, and Business Management. It also includes the Managing Broker Cram course.

Brokerage Management Correspondence Course (30 clock hours)

This is one of three courses required for managing broker license eligibility. It may also be used for the 30-hour continuing education requirement. This correspondence course covers a full range of topics and activities that will prove useful—even essential—to anyone who aspires to own a brokerage, who is interested in managing an office, or who expects to function in any kind of supervisory position in the future. Since it’s a correspondence course, you can complete it anywhere, anytime, at your own pace. Simply read the textbook, and take the online lesson quizzes and the final exam.

Business Management Correspondence Course (30 clock hours)

This 30 clock hour correspondence course guides managing broker candidates through the techniques of managing their own business. It covers such topics as: starting a service-oriented business; developing a business plan; financing a business; marketing; public relations; and office management. Since it’s a correspondence course, you can complete it anywhere, anytime, at your own pace. Simply read the textbook, and take the online lesson quizzes and the final exam. Note: this course may also be used for the 30-hour continuing education requirement.

Advanced Washington Real Estate Law (30 clock hours)

Advanced Washington Real Estate Law offers a 30 clock hour overview of the legal aspects of real estate. This course discusses the laws governing the ownership and sale of real estate in Washington, examines common problems in real estate transactions, and provides examples from actual court cases. You must complete this course if you wish to take the managing broker’s license exam. Topics covered include:

- real estate license law,

- the distinction between real and personal property,

- methods of land description,

- easements, liens, and other interests in real estate,

- forms of co-ownership,

- the law of real estate agency,

- earnest money agreements and other real estate contracts,

- deeds and title transfer,

- deeds of trust, mortgages, and foreclosure,

- zoning and other land use controls,

- taxation of real estate,

- fair housing issues,

- landlord/tenant law, and

- employment law

Managing Broker’s Cram

While no one can really guarantee that you’ll pass the managing broker’s license exam, the Managing Broker’s Cram online course provides the greatest possible assurance. This course takes all the information taught in Rockwell’s live Cram course, puts it in a highly usable format on the computer, and allows you to learn it at your own pace. You are shown what is likely to be tested on the license examination, plus you get the opportunity to answer hundreds of practice exam questions and take several practice exams.

The Cram narrows your search for relevant topics, saving you both time and unnecessary stress. As the exam date approaches, nothing is more frustrating and stressful than studying in great detail information that may be altogether unimportant. Save yourself a lot of needless grief and enroll in the Cram course today.

First Renewal Package (90 clock hours)

Sign up for all 90 clock hours of courses required for your first license renewal (Real Estate Advanced Practices, Real Estate Law, a 30-hour Elective, and Core Curriculum) in this convenient package, and save money!

Advanced Real Estate Practices (30 clock hours)

Advanced Real Estate Practices provides an in-depth look at many of the issues that real estate agents in Washington encounter on a day-to-day basis, plus it examines complications that can arise in brokerage operations and real estate transactions. Advanced Practices covers, among other topics, risk reduction strategies, negotiating contracts, pricing and marketing properties, and the development and sale of vacant land. This 30 clock hour course is part of the state’s first renewal requirements for brokers.

Washington Real Estate Law (30 clock hours)

Washington Real Estate Law offers a 30 clock hour overview of the legal aspects of real estate. This course discusses the laws governing the ownership and sale of real estate in Washington, examines common problems in real estate transactions, and provides examples from actual court cases. Topics covered include:

- the distinction between real and personal property,

- methods of land description,

- easements, liens, and other interests in real estate,

- forms of co-ownership,

- the law of real estate agency,

- earnest money agreements and other real estate contracts,

- deeds and title transfer,

- deeds of trust, mortgages, and foreclosure,

- zoning and other land use controls,

- taxation of real estate,

- fair housing issues, and

- landlord/tenant law

Washington Core Curriculum (3 clock hours)

This online Core Curriculum course covers new topics relevant to residential real estate. This 3-hour course discusses rules about referrals and workers’ compensation, property management, and handling distressed properties and short sales. All brokers and managing brokers must take this course as part of the clock hours needed for license renewal.

Financing Residential Real Estate (30 clock hours)

Financing Residential Real Estate gives you a 30 clock hour overview of both the lending process and the guidelines used to qualify homebuyers for mortgage loans. This course provides you with a solid understanding of the following topics:

- the loan application process,

- loan underwriting standards,

- conventional loans,

- FHA loans,

- VA loans,

- seller financing,

- fair lending, and

- predatory lending

Washington Real Estate Practices for CE Only (30 clock hours)

This is a 30 clock hour practical course for new agents. It offers guidelines in areas such as: listing agreements and purchase and sale agreements; pricing property; qualifying the purchaser; agency relationships; financing; and other information pertinent to the new real estate agent.

Principles of Washington Real Estate (30 clock hours)

Even if you’re not a broker’s license applicant, Principles of Washington Real Estate is an ideal way to brush up on all the fundamental aspects of practicing real estate, from appurtenances to zoning. This course provides 30 hours of credit toward continuing education requirements, and is now available online.

Washington Real Estate Appraisal (30 clock hours)

Real Estate Appraisal gives you a 30 clock hour overview of both the theoretical and practical aspects of the subject, with an emphasis on residential appraisal practices. Real Estate Appraisal will provide you with a solid understanding of the following topics:

- The eight steps of the appraisal process

- Architectural styles

- Construction methods and materials

- Collection and analysis of appraisal data

- Analyzing the highest and best use of a property

- Estimating cost and depreciation

- Selecting and analyzing comparable properties

- The three methods of appraisal

- Preparing appraisal reports

Property Management (27 clock hours)

Property Management is a 27 clock hour comprehensive introduction to managing investment real estate, including residential properties (apartment buildings and single-family rental homes) and commercial properties (office, retail, and industrial space). The topics covered include:

- the economics of real estate investment

- working with management clients

- management planning

- operating budgets and other financial aspects of property management

- marketing rental properties

- marketing property management services

- tenant selection and lease negotiations

- rent collection

- security deposits

- lease termination and eviction

- staffing managed property

- property maintenance

- laws affecting property management, and

- emergency preparedness, security, and insurance issues

Understanding Conventional, FHA, and VA Loans (7.5 clock hours)

This 7.5 clock hour online course covers the main loan programs available to the home buyer today. First, it examines the basics of conventional loans, including special programs and alternative payment plans. Next, the course engages in a detailed exploration of the two main government-sponsored loan programs-FHA and VA loans. Through use of colorful photographs, crisp graphics, and entertaining animations, this course makes the intricate concepts of real estate financing easy to learn and remember.

Mortgage Financing: Application and Approval (7.5 clock hours)

Mortgage Financing is a 7.5 clock hour course that covers the ins and outs of the loan application process. From the initial application through escrow, the course provides an in-depth look at topics such as choosing a loan, applying for credit, qualifying the buyer and the property, and closing the transaction. State of the art online graphics make the course a treat for the eyes, while clear and concise explanations make the material easy to master.

Mathematics of Selling Real Estate (7.5 clock hours)

This 7.5 clock hour course is designed to give real estate agents the basic problem-solving skills that will prepare them for all types of real-world situations involving math calculations. The course begins with elementary topics such as conversion of fractions, decimals, and percentages, calculation of area and volume, calculation of loan amounts and interest rates, and calculation of commissions. Students will then advance to more complex problems involving appreciation and depreciation, capitalization, and proration of expenses.

Washington License Law (7.5 clock hours)

This 7.5 clock hour course is designed to familiarize real estate agents with all aspects of Washington real estate license law, and to keep them apprised of new developments in the law so they can stay in compliance. The course begins with an explanation of when a license is required and how a license is obtained and renewed. It also details the regulation of business practices, including topics such as agency disclosure requirements, trust account and recordkeeping requirements, and a broker’s supervisory responsibilities. Finally, the course explains the disciplinary procedures for license law violations.

Appraisal Valuation Techniques (7 clock hour)

Appraisal Valuation Techniques gives you a 7 clock hour overview of the practical aspects of valuing property, with an emphasis on residential appraisal practices. Appraisal Valuation Techniques will provide you with a solid understanding of the following topics:

- The cost approach to value

- The sales comparison approach to value

- The income approach to value

- Site valuation

- Appraising special interests

- Preparing appraisal reports

Mortgage Loan Basics (6 clock hours)

Mortgage Loan Basics is our most general course on the real estate lending process. It introduces the student to the basic features of a residential loan and to the documents used in the lending process. Rudimentary concepts such as amortization, loan-to-value ratios, mortgage insurance, secondary financing, and interest rates are clearly explained in this course. The 6 clock hour online presentation of the material makes the learning process interactive and entertaining.

Essential Principles of Appraisal (4 clock hours)

Essential Principles of Appraisal gives you a 4 clock hour overview of the principles of valuing property, with an emphasis on residential appraisal. Essential Principles of Appraisal will provide you with a solid understanding of the following topics:

Course Outline:

- The appraisal profession

- The principles of value

- The appraisal process

- Data collection and analysis

Essentials of Property Management (3 clock hours)

Essentials of Property Management gives you a 3 clock hour overview of the property management, with an emphasis on managing residential properties. Essentials of Property Management will provide you with a solid understanding of the following topics:

- The management plan

- Management functions

- Lease provisions

- Landlord/tenant law

The Seller as Lender: Seller Financing Explained (3 clock hours)

The Seller as Lender 3 clock hour class teaches everything a student needs to know about seller financing. The course begins by explaining why seller financing is used, then proceeds to cover all topics relevant to someone contemplating a seller-financed transaction-seller seconds, primary seller financing, and alternatives to seller financing such as buy-downs and lease arrangements. The course concludes with a brief look at the real estate agent’s responsibilities in a seller-financed transaction. The online presentation of the material is detailed, organized, and easy to follow.

Real Estate Construction, Ownership, and Investment (3 clock hours)

Many of a client’s most pressing questions will not concern the fine points of real estate law but more practical concerns, like whether a house appears to be solidly constructed, or whether it’s even a good idea to buy property at all. This 3 clock hour course will prepare a real estate agent to answer these questions. It includes an overview of how residential property is constructed, other pointers for evaluating a home, a worksheet for helping clients decide whether to rent or buy, and special considerations for clients looking for investment or income property.

Course Outline:

- Home Construction

- The Decision to Rent or Buy

- Evaluating a Home

- Investing in Real Estate

Borrower Beware: Fair Lending/Consumer Protection (3 clock hours)

This 3 clock hour online course teaches the student how to avoid the pitfalls of real estate financing. First the student is introduced to the key laws enacted to protect the borrower: the Equal Credit Opportunity Act, the Fair Housing Act, the Home Mortgage Disclosure Act, the Truth in Lending Act, and the Real Estate Settlement Procedures Act. These laws are examined in detail, with illustrations and examples used to enhance comprehension. The course concludes by taking a look at predatory lending practices and the measures taken to curb them. A lively and colorful online presentation brings the course content to life.

Risk Management (3 clock hours)

Risk Management teaches you about managing the risks inherent in managing a real estate business. The course begins by discussing reactive strategies for risk management (such as errors and omissions insurance policies), then moves on to proactive strategies (such as supervision and training). The course discusses how to deal with the risks associated with agency and property disclosures, contracts, trust funds, advertising, antidiscrimination laws, antitrust Laws, RESPA, and predatory lending. This 3 clock hour course then concludes with a section on legal remedies. DRE course approval number: 1077-1010

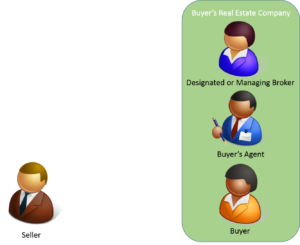

On the surface, this seems easy and the obvious scenario is one where a person selling a house ‘for sale by owner’ (FSBO) finds a buyer. No real estate agent is involved, so there is no agency relationship. But, we’ve also seen cases where a FSBO owner or buyer asks a real estate agent to handle paperwork for a fee, without creating an agency relationship. The challenge here is that the agent will likely, at some point in the transaction, offer advice to either the seller or buyer, thereby creating an agency relationship without meaning to do so. As the owner of a real estate brokerage, I see this as a recipe for law suits, and since ultimately it is my responsibility, I don’t want my brokers doing this. If a FSBO buyer and seller needs help with paperwork, they can contact an escrow company or an attorney to guide them through the process.

On the surface, this seems easy and the obvious scenario is one where a person selling a house ‘for sale by owner’ (FSBO) finds a buyer. No real estate agent is involved, so there is no agency relationship. But, we’ve also seen cases where a FSBO owner or buyer asks a real estate agent to handle paperwork for a fee, without creating an agency relationship. The challenge here is that the agent will likely, at some point in the transaction, offer advice to either the seller or buyer, thereby creating an agency relationship without meaning to do so. As the owner of a real estate brokerage, I see this as a recipe for law suits, and since ultimately it is my responsibility, I don’t want my brokers doing this. If a FSBO buyer and seller needs help with paperwork, they can contact an escrow company or an attorney to guide them through the process.