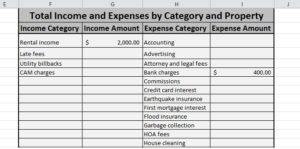

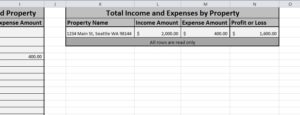

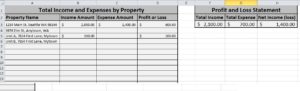

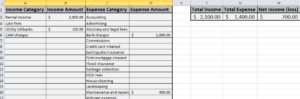

Tax time is closer than you think. Instead of waiting till the last minute and handing your accountant a box of receipts, you can use this handy spreadsheet to organize your income and expenses. My accountant said she would love to have all her landlord clients using something like this, so here is one small step to making that happen.

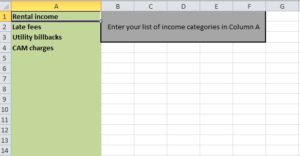

The spreadsheet is flexible enough to let you add lots of entries and extra expense categories. But, if you want the password (its there to help keep you from accidentally breaking the functions), just leave a comment and I’ll send it to you.

Good luck and good organizing!