Spreadsheet is updated as of 12/18/2016!

Are you done putting together your tax paperwork? I just finished mine and my accountant liked the spreadsheet. In the process of using it I found, and fixed a few bugs, so if you tried it before… try it again. And, if you haven’t started your taxes yet, its a great time to do so.

Here is the original post with some information about the spreadsheet, and links to full instructions.

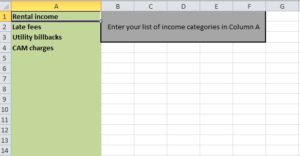

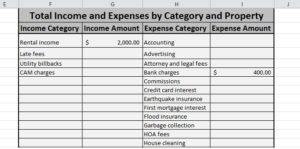

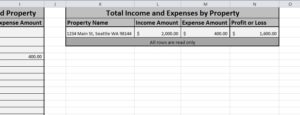

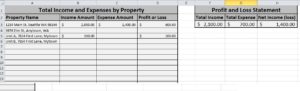

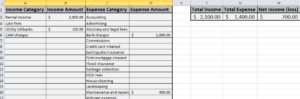

We’ve created this simple spreadsheet, that we use ourselves, to track our rental income and expenses, and to report information to our accountant. With it, you can create reports, including a Profit and Loss Statement (P&L) for each property or unit. You can also see how much you are spending by category. The spreadsheet is designed to do a lot of the basic work for you, while being customizable. You can add your own properties, expense categories, and income categories for use in tracking and reporting.

You can find a full description, and simple instructions here….

The link to the article is fixed.

Hey guys, thanks for the great expense tracking spreadsheet. I’ve tried several times to get the ‘Invdividual Property Report’ to generate a report, but all I’m seeing is error codes and blanks.

Before putting in more time entering data wondered if anyone else had this problem, and if you

have a ready solution, or if you can point me to a similar SW package.

BTW; the other reports are working fine.

Thanks in advance, Bob Bihler

Copy paste of what I’m seeing on the Individual Property Report sheet:

Income Category Income Amount Expense Category Expense Amount

#NAME? #NAME? #NAME? #NAME?

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

Rental income Accounting

Late fees Advertising

Utility billbacks Attorney and legal fees

CAM charges Bank charges

Hi Bob, I’ll check it out and let you know what I find out shortly.

Hi Bob, I’m not able to reproduce the problem you are seeing right off. The kinds of errors you are seeing are typical in Excel if the references to cells are messed up for some reason. this can happen if sheets get renamed or something similar.

For example, if you select the first cell in that report that has an error you should see something like this in the formula box:

=IF(‘Income Categories’!A1=””,””,’Income Categories’!A1)

If you want, send me your spreadsheet in email and I’ll take a look. I can probably figure out what happened plus it would give me a chance to see if there is a way I can prevent it from happening in the future. 🙂

Another free option for doing this sort of thing is a web application called “TrexGlobal” that will let you track income and expenses for free, up to a certain number of properties. I used to use it myself. Here is a link: http://www.trexglobal.com/partner/jason_hershey (if you sign up with this link, you simply see my smiling face at the bottom of your page when you sign in)

a quick question in reference to this spreadsheet, is there to modify so that you can use a negative dollar value when entering in the expense sheet. In other words say I have paid a utility bill of $150 and I ended getting a refund from the utility company of $50 after 2 months. So I would need to enter -50 and reduce the utility expense by $50. Thanks

I’m having trouble entering the name of my property in the “Property/Unit” column. It displays a drop-down menu, asking me to add the name of my property to that before I add it to the column. I’ve tried to figure out how to do this via just general Googling for using excel spreadsheets, but haven’t had any luck. Can you give any help here?

There is actually a separate sheet for entering property names. It is the last sheet in the workbook, named PropertyUnit_list

I’ve entered property names on the unit list and did a test income and expense entry just to see what it would look like on the various reports but I was unable to see anything but error messages on the report. Before I get too into filling this whole thing out, could you show me what I might be missing here?

Thanks!

https://drive.google.com/file/d/0B1a0f90CZjyXdHNjR3ROdGFrSWs/view?usp=sharing

Hi Julie,

I can’t get to the file on your google drive for some reason. Want to email me a copy? Jason.Hershey@tellusre.com

When I enter an expense on line 100 on the expense tab all is fine , when I enter an expense on line 101 I get an error on the individual property report tab . Any thoughts ? Same goes for Income entry .

Thanks Tim

Hi Tim! Thanks for catching this. The formula is only looking at the values through row 100, so I need to update it. I’m getting ready to post an update to the spreadsheet and will include this change with the update. Thanks!

First, let me say thank you for this wonderful Free tool. Its just what I’ve been looking for; having said that, I was wondering if you posted an update to the worksheet to address the issue that Tim (Tim on March 27, 2015 at 10:17 pm) was having; not being able to get pass the errors after line 100. I have about 300 individual entries. Thanks in advance.

Thank you for the profit and loss spreadsheet. I am experiencing the same error that Bob Bihler posted above in 2013. I have entered expenses for a unit, but they don’t show up on the individual unit report. The dollar amounts there are blank.

Anything I can check for on my end?

Are you using the standard version of Excel? It may not work with Excel online, or with excel compatible applications like Numbers or Google’s version. If you want, you can email me a copy and I can see if it will open on my end.

Is therre a way to produce a balance sheet by linking to your spereassheet. Sorry i am illiterae when it comes to accounting.

Not really. If you assign the purchase of any assets to their own expense category (or categories), it would help you in maintaining your balance sheet. You could simply use that total to update the balance sheet category (adding to the balance). The cash account in the balance sheet might be updatable by subtracting all the expenses from that… assuming you are running everything on a cash basis.

Hope that helps.

Jason,

Started using your spreadsheet a couple of days ago.

It is just what I have been looking for. We have owned an ocean front vacation rental property in Yachts, OR since 1999.

I used Quickin 2004 till it crashed. Intuit does not support the Mac very well.

I have run into a small problem, with your spreadsheet. For some reason, A26 is trying to look like a cell in row 4, of the expense tab.

When I try to run a Portfolio Cat Summary, it is giving me incorrect totals. My totals for garbage should be 466.50/ it is only finding $400.

It is also giving me several #REF! in the summary.

I do know a bit about Excel, but not enough to figure this one out.

I there anyway to sort the column A, the date column, after I have entered data?

I am attaching a copy of my data.

Hoping to sell the property this Spring. Retirement time!

Regards and thanks for your help.

Jim Hueske

5415540891

Sent an email the other day. Can’t attach here.

Anyone knows what I am not able to update the workbook? It’s protected and asking me for a password

some fields are locked to prevent accidental training, but we posted a new version. See here: tellusre.com/residential-real-estate/updated-rental-profit-and-loss-spreadsheet/

I love this spreadsheet! I would like to use it for other things besides my rental properties like home income and expense and my guardianship Annual Report. Is there a way to change the Header/Title? For example from Rental Property to Home Budget or Guardianship Annual Report..etc.